Preparing for the New W-4 Form in 2020

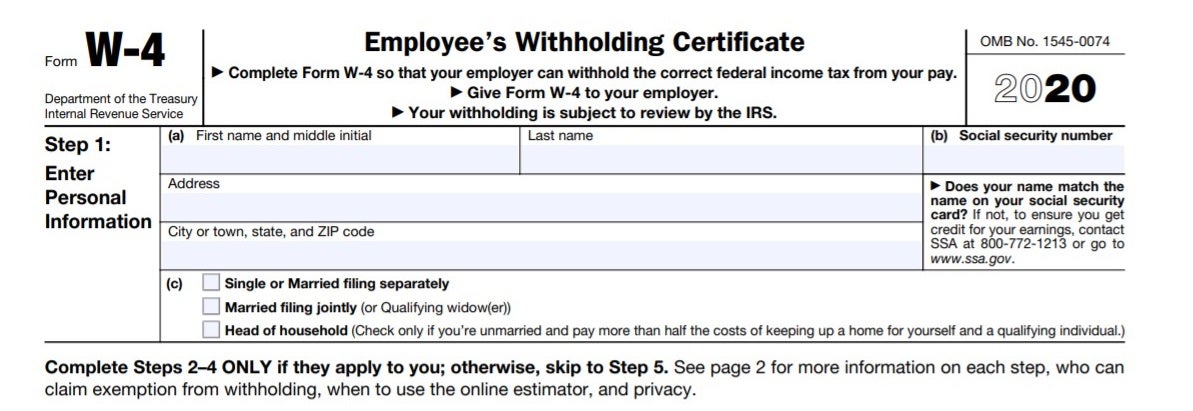

Earlier this month the IRS released the final version of an updated Form W-4 (Employee’s Withholding Certificate) for 2020. While we’ve all known it’s been coming (especially since the draft versions were released in June and August), technology companies around the country are now scrambling to make sure their products and services support the new form’s requirements.

Earlier this month the IRS released the final version of an updated Form W-4 (Employee’s Withholding Certificate) for 2020. While we’ve all known it’s been coming (especially since the draft versions were released in June and August), technology companies around the country are now scrambling to make sure their products and services support the new form’s requirements.

If you have responsibility for onboarding new employees, you should be aware of the requirements to use the new form. According to the IRS’ website:

- If a new hire is hired in 2019, but first day of work is in 2020, then the employee must complete the redesigned 2020 W-4

- If a new hire starts in 2019, then no action is required unless the new hire wants to adjust their withholdings in 2020

The good news for Jobvite customers is that Jobvite Onboard will be updated on January 1, 2020 to ensure the correct Form W-4 is available. If a new hire is hired in 2019, but first day of work is in 2020, then the employee must complete the redesigned 2020 Form W-4.

- Jobvite Onboard supports two options if the new hire already completed the 2019 W-4 Task:

- If the event is still active, reopen the W-4 Task and ask the new hire to complete

- If the event is completed, have the new hire complete the new 2020 W-4 form manually

If a new hire starts in 2019 and wants to adjust their withholdings in 2020, then the new hire is required to complete the new 2020 W-4 form.

If you or a vendor/partner use the Jobvite API to retrieve W-4 information, you will want to verify that you are also capturing the data that will be in the new fields. Please contact your Jobvite customer success manager to request an addendum listing the changes required by the new form.

We hope this information is helpful as you prepare for 2020.